What is a Credit Memo? Definition and examples

Some might use and re-use templates this way, but that still requires proofreading to make sure a previous client’s data wasn’t inadvertently left in a field. One reason they do is that writing an effective credit memo is important. At the same time, this document can become extremely complex and large because it has a lot of data coming from various sources. This Credit Memorandum acknowledges that XYZ Electronics returned $913.75 worth of products due to a defect or other valid reasons. It records the adjustment in your accounts, reducing the amount receivable from XYZ Electronics by $913.75 and accounting for the return of these items in the Sales Returns and Allowances account.

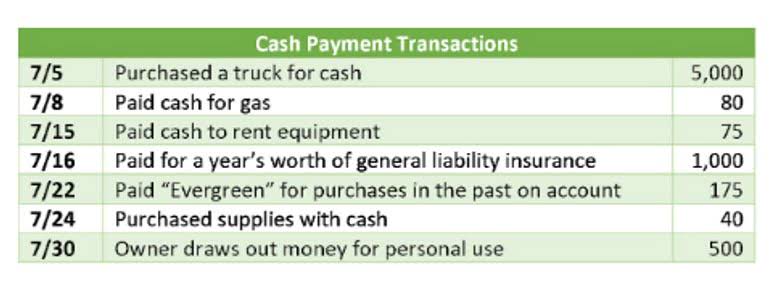

All of this information helps a seller to keep track of inventory. Banks and other financial institutions also use credit memos on their statements to indicate when a customer’s account balance has increased for a certain transaction. It’s a best practice for sellers to obtain proper approval and maintain documentation before issuing any credit memos to buyers.

Credit Memos for Bank Transactions

For a brick-and-mortar store, it is a store credit and not a credit note. Here, the Accounts Payable takes it as a debit note and the Cash account accepts it as a credit entry. The store credit debits the Cash account while making it the credit entry for Accounts Payable when the businesses do not refund the amount to customers. An external note is one that is sent to buyers to inform them about the outstanding credit on their account.

- OnEntrepreneur is the go-to source for entrepreneurs looking to get ahead.

- Now that you know what is a credit memo and why it is important to record and issue it.

- “Everyone knows where to look for a certain piece of information,” she says.

- It records the adjustment in your accounts, reducing the amount receivable from XYZ Electronics by $913.75 and accounting for the return of these items in the Sales Returns and Allowances account.

- The most common reasons involve a buyer returning goods, a price dispute, or as a marketing allowance.

On the contrary, an internal credit memo is prepared by sellers to ensure accurate account management. In the latter case, the buyers remain unaware of this credit amount. One type of credit memo is issued by a seller in order to reduce the amount that a customer owes from a previously issued sales invoice. Another type of credit memo, or credit memorandum, is issued by a bank when it increases a depositor’s checking account for a certain transaction. If the buyer has not yet paid the seller, the buyer can use the credit memo as a partial offset to its invoice-based payment to the seller.

Credit Memo: How To Record & Issue It?

We will discuss different reasons briefly in this blog further. There are many reasons why credit memos are issued by sellers to buyers. No matter why you need to change an invoice, QuickBooks’ invoicing software makes issuing and sending credit credit memo notes quick and easy. You can also create a branded credit note template to save even more time in the future. A credit memo, also known as a credit memorandum, is a document issued by the buyer to the seller and is different from an invoice.

Their purpose is to correct any sales situation that demands a reduction in the amount of goods or services sold previously. Credit memos are always tied to a previous invoice and they are normally used when a customer receives damaged goods, incomplete orders, or wrong products. They are also issued if some products were returned for warranty purposes; and, sometimes, they are used to give the client a previously-negotiated discount or to correct any mistake on the invoice.

What The IRS ERC Memorandum Means And How To Optimize Your Claim

If the customer opts for a credit towards future purchases, you would adjust the customer’s account accordingly instead of crediting the Cash account. Let’s assume that you issued a Credit Memorandum to a customer for a refund of $500 due to a defective product they returned. Do not confuse it with a refund as in the refund you get the full amount back. The debit memo means the remaining amount a person has to pay with no deduction or discount. A credit memo is a document sent to a buyer from a seller reducing the amount owed by the buyer to the seller.

- An invoice is a document issued by a seller of goods or services indicating to a buyer the amount of money it owes for the goods and services purchased.

- A credit memorandum, or credit memo for short, can reduce the price of a good or service or eliminate its cost.

- In this scenario, a credit memorandum should be used since the company needs to reduce a previously issued invoice to compensate the client for the damaged goods.

- It’s a best practice for sellers to obtain proper approval and maintain documentation before issuing any credit memos to buyers.

- The sender of a credit memo always records a credit in its books.

However, if the buyer already has paid the full invoice and prefers a cash payment instead of a credit on another order, they can ask for one. In the seller’s bookkeeping records, the credit memo will show a debit of $20 to Returns and Allowances (Sales) and a credit of $20 to Accounts Receivable. Following the return of the goods, the seller issues a credit note of https://www.bookstime.com/ $1,000 reflecting the 10 items returned. Typically, the credit memo will provide the buyer or client information as to the reason why the credit memo has been issued and to which invoice it relates to. Regardless of the reason or circumstances surrounding the situation, credit memos become an important part of credit transactions when they occur and in the future.